It can be difficult to navigate the Medicare Services in Beaverton, especially with so many possibilities. To make sure your healthcare is sufficiently covered, it's important to select the plan that best meets your needs. This blog will walk you through Beaverton's best Medicare providers so you can weigh your alternatives and make an educated choice.

Medicare: An Overview of the Fundamentals

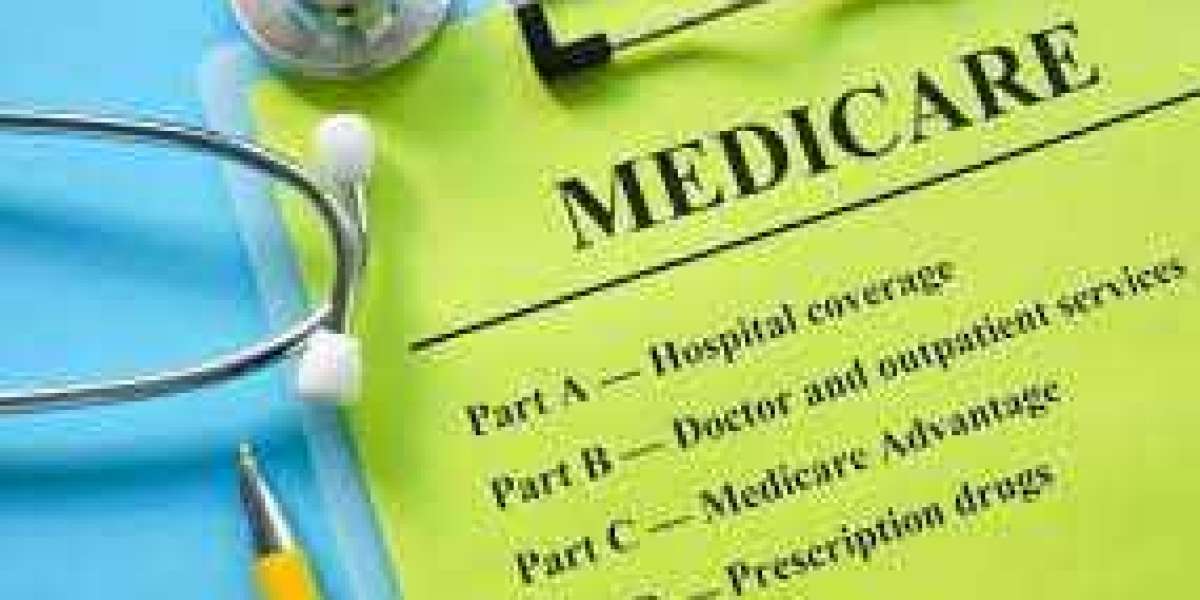

Medicare is a government health insurance program that covers some people with disabilities who are younger, although it is primarily intended for those who are 65 years of age and older. Medicare is split up into various sections, each providing a particular set of benefits:

- Hospice care, skilled nursing facility care, inpatient hospital treatment, and a portion of home health care are all covered under Part A (Hospital Insurance).

- Outpatient care, preventative services, medical supplies, and physician services are all covered under Part B (Medical Insurance).

- Medicare Advantage Plans (Part C): A Medicare-approved commercial company offers an alternative to Original Medicare. Part A, Part B, and frequently Part D (prescription medication coverage) are included in these plans.

- Prescription medication costs are partially covered by Part D (Prescription Drug Coverage).

- Selecting the best Medicare services in Beaverton requires first comprehending the many benefits that each of these components offers.

Assessing Your Needs for Medical Care

It is important to determine your healthcare needs before delving into Beaverton's specific Medicare offerings. Take into account the following elements:

Present Health Status: Do you suffer from any long-term illnesses that need to be treated on a regular basis?

Preferred Physicians and Hospitals: Does the plan you are thinking about cover your preferred physicians and hospitals?

Prescription Drugs: Do you routinely use any prescription medications? If so, are they covered by the plan's formulary?

Budget: What is the maximum amount you can afford to pay for out-of-pocket expenses, deductibles, and premiums?

Knowing what medical care you actually need can help you focus your search and select the Medicare services that best fit your needs.

Medicare Plan Types in Beaverton

Beaverton provides a range of Medicare plans, each with different prices and benefits. The most prevalent kinds are broken down as follows:

Medicare Parts A and B Original:

Advantages: national coverage, freedom to select healthcare providers, and lack of requirement for referrals to consult specialists.

Cons: There is no out-of-pocket cap, and prescription medications, dental, vision, and hearing services are not covered.

Part C of Medicare Advantage Plans:

Advantages: All Original Medicare benefits are covered, frequently with additional coverage for prescription medicines, dentistry, vision, and hearing, and predictable out-of-pocket expenses.

Cons: May need referrals for specialists; restricted to a network of physicians and hospitals.

Medigap, or Medicare Supplement Plans:

- Advantages: Freedom to select any physician or hospital that takes Medicare; helps pay for out-of-pocket expenses not covered by Original Medicare (such as copayments, coinsurance, and deductibles).

- Cons: Higher premiums and the need for a separate Part D plan as prescription medication coverage is not included.

Medicare Prescription Drug Plans, Part D:

- Advantages: Offers defence against exorbitant prescription costs and assistance in paying for prescription drugs.

- Cons: You may have limitations on the pharmacies you can use, as well as monthly premiums and out-of-pocket expenses.

Medicare Plan Comparison

The following elements should be taken into account when comparing Medicare services in Beaverton:

- Coverage: Are the services you require covered by the plan? Verify if the hospitals, pharmacies, and physicians of your choice are covered by your plan.

- Costs: Examine out-of-pocket maximums, copayments, deductibles, and premiums. If you take prescription drugs on a regular basis, don't forget to account for the expense of such drugs.

- Plan Flexibility: While some plans provide you more choice to select your healthcare providers, others may require you to obtain recommendations for specialists.

- Extra Benefits: A lot of Medicare Advantage plans provide extra benefits including wellness, dental, vision, and hearing care. Think about how significant you find these advantages to be.

Medicare rates and star ratings plans for advantages based on effectiveness and quality. Plans with higher ratings could provide better care and services.

Dates Enrolment Periods

In Beaverton, knowing when and how to sign up for Medicare services is essential to maintaining ongoing coverage and avoiding late enrolment fines. These are the important times to enrol:

- The Initial Enrolment Period (IEP) lasts for three months, starting the month before your 65th birthday and ending three months later. You can select a Part D or Medicare Advantage plan during this time, as well as enrol in Medicare Parts A and B.

- You can switch Medicare Advantage plans, Original Medicare to Medicare Advantage (or vice versa), or Part D plans during Medicare Open Enrolment, which runs from October 15 to December 7.

- The Special Enrolment Period (SEP) is available to those who go through specific life events, including as moving outside of the service area of your plan, losing employer-sponsored coverage, or being eligible for further assistance.

Looking for Professional Guidance

While knowing the fundamentals of Medicare is important, speaking with a Medicare expert can help you choose the right plan for your individual circumstances. These experts can guide you through the complexity of Beaverton Medicare services so you can select a plan that fits both your needs and your budget for healthcare.

Beaverton's Premier Medicare Services

With their knowledgeable counsel and attentive care, Michaels Medicare Ministry stands out as the best provider of Medicare services in Beaverton. Their experienced staff is committed to assisting you in locating the finest Medicare plans that meet your individual requirements. You can rely on them to help you navigate the procedure and make sure you get the coverage you are entitled to.

Evaluating various

Selecting the best Medicare services in Beaverton requires knowing when to enrol, evaluating various plans, and comprehending your healthcare requirements. You can select a Medicare plan that offers the coverage and assurance you require as you proceed through your healthcare journey by carefully weighing your alternatives and, when required, consulting an expert.