Market Overview

The Vendor Neutral Archive (VNA) Market is witnessing robust growth due to the increasing need for medical image storage, interoperability, and seamless data access across healthcare systems. A Vendor Neutral Archive (VNA) is a centralized repository that enables healthcare providers to store, retrieve, and manage medical imaging and patient data from multiple Picture Archiving and Communication Systems (PACS) in a standardized format. The rising adoption of cloud-based VNA solutions and the demand for data integration in healthcare IT infrastructure are driving market expansion.

Hospitals, diagnostic centers, and research institutes are increasingly investing in VNA systems to improve clinical workflow, patient data sharing, and long-term image archiving. Moreover, regulatory requirements for healthcare data standardization and compliance have accelerated the need for interoperable medical image management solutions.

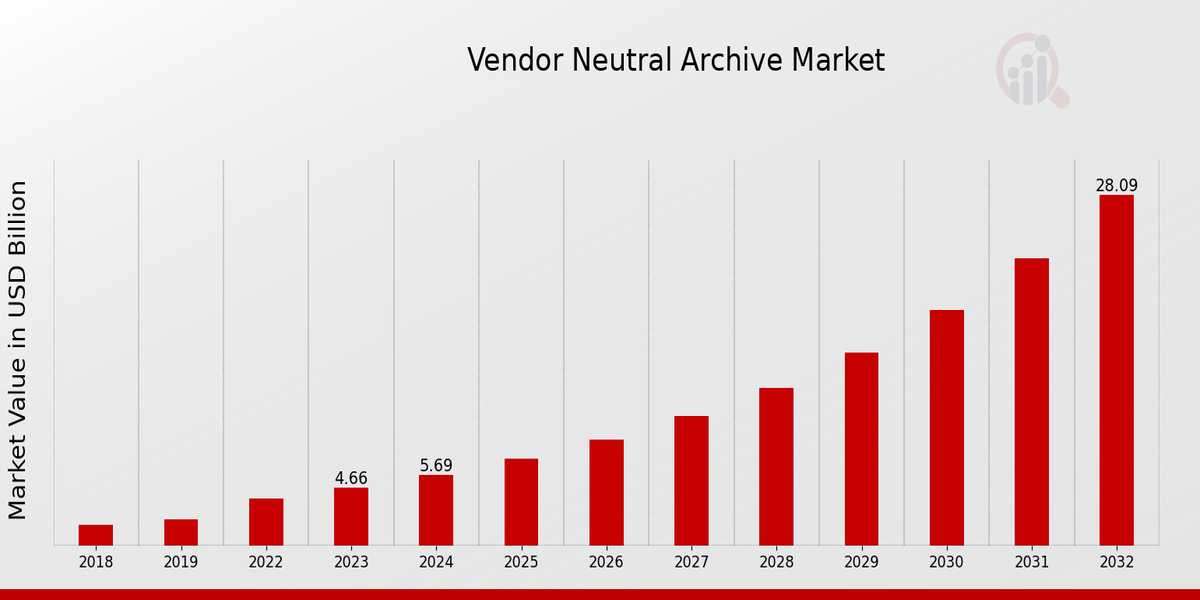

Market Size and Share

The Vendor Neutral Archive Market Size was estimated at 3.82 (USD Billion) in 2022. The Vendor Neutral Archive Market Industry is expected to grow from 4.66(USD Billion) in 2023 to 28.1 (USD Billion) by 2032. The Vendor Neutral Archive Market CAGR (growth rate) is expected to be around 22.08% during the forecast period (2024 - 2032).North America leads the market due to stringent healthcare regulations, technological advancements, and strong adoption of health IT solutions, while the Asia-Pacific region is expected to experience significant growth due to increasing healthcare digitization and government initiatives for electronic health record (EHR) adoption.

Market Drivers

- Growing Adoption of Healthcare IT Solutions: The need for secure and scalable medical image archiving is driving the adoption of VNA platforms.

- Rising Demand for Interoperability and Data Integration: VNAs allow seamless exchange of imaging data across different PACS, enhancing clinical decision-making.

- Regulatory Compliance and Data Standardization: Healthcare organizations must comply with HIPAA, DICOM, and HL7 standards, fueling the demand for vendor-neutral data storage.

- Shift Towards Cloud-Based VNA Solutions: The increasing adoption of cloud-based VNAs is reducing infrastructure costs and improving data accessibility.

- Increase in Medical Imaging Procedures: The rise in radiology, cardiology, and oncology imaging has led to higher storage requirements, boosting VNA adoption.

Challenges and Restraints

- High Initial Implementation Costs: The deployment of VNA solutions involves significant upfront investments in IT infrastructure and data migration.

- Data Security and Privacy Concerns: Protecting patient health information (PHI) against cyber threats remains a major challenge.

- Integration Challenges with Legacy PACS: Compatibility issues between existing PACS and new VNA solutions can hinder smooth implementation.

Market Trends

- Advancements in AI and Machine Learning for Image Management: AI-powered image analytics and automated workflows are enhancing medical imaging efficiency.

- Rising Adoption of Cloud-Based VNAs: The shift towards cloud computing in healthcare is increasing the scalability and accessibility of VNA platforms.

- Focus on Multi-Site and Cross-Enterprise Data Sharing: VNAs are enabling healthcare networks to share imaging data seamlessly across locations.

- Expansion of Vendor-Agnostic Imaging Solutions: Companies are focusing on customized VNA solutions to improve healthcare data interoperability.

Regional Analysis

- North America: Dominates the market due to strong regulatory frameworks, advanced healthcare IT infrastructure, and high adoption of PACS and VNA systems.

- Europe: Growth is driven by government support for digital healthcare, increasing radiology procedures, and rising demand for data standardization.

- Asia-Pacific: Fastest-growing region due to rapid healthcare digitalization, increasing investments in medical imaging, and growing hospital networks.

- Rest of the World: The market is gradually expanding in Latin America and the Middle East due to improving healthcare infrastructure.

Segmental Analysis

- By Deployment Mode:

- On-Premise VNA

- Cloud-Based VNA

- Hybrid VNA

- By Vendor Type:

- PACS Vendors

- Independent Software Vendors

- Infrastructure Vendors

- By End-User:

- Hospitals Clinics

- Diagnostic Imaging Centers

- Research Institutes

Key Market Players

- VNA Health

- Merge Healthcare Inc.

- Visage Imagin

- Xerox Corporation

- GE Healthcare

- Caresyntax AG

- Canon Medical

Recent Developments

- Launch of AI-Integrated VNA Solutions: Companies are introducing AI-driven image analytics and automation in VNA platforms.

- Expansion of Cloud-Based VNA Offerings: Major players are focusing on scalable, cloud-based image archiving solutions for healthcare providers.

- Partnerships for Enhanced Interoperability: Collaborations between VNA providers and EHR vendors are improving seamless data exchange.

For more information, please visit us at marketresearchfuture.